Wearing one ugly Christmas sweater for a party can be fun, but if soaring energy costs have you

wearing all your sweaters at once to avoid raising your thermostat, it might be time to go

green.

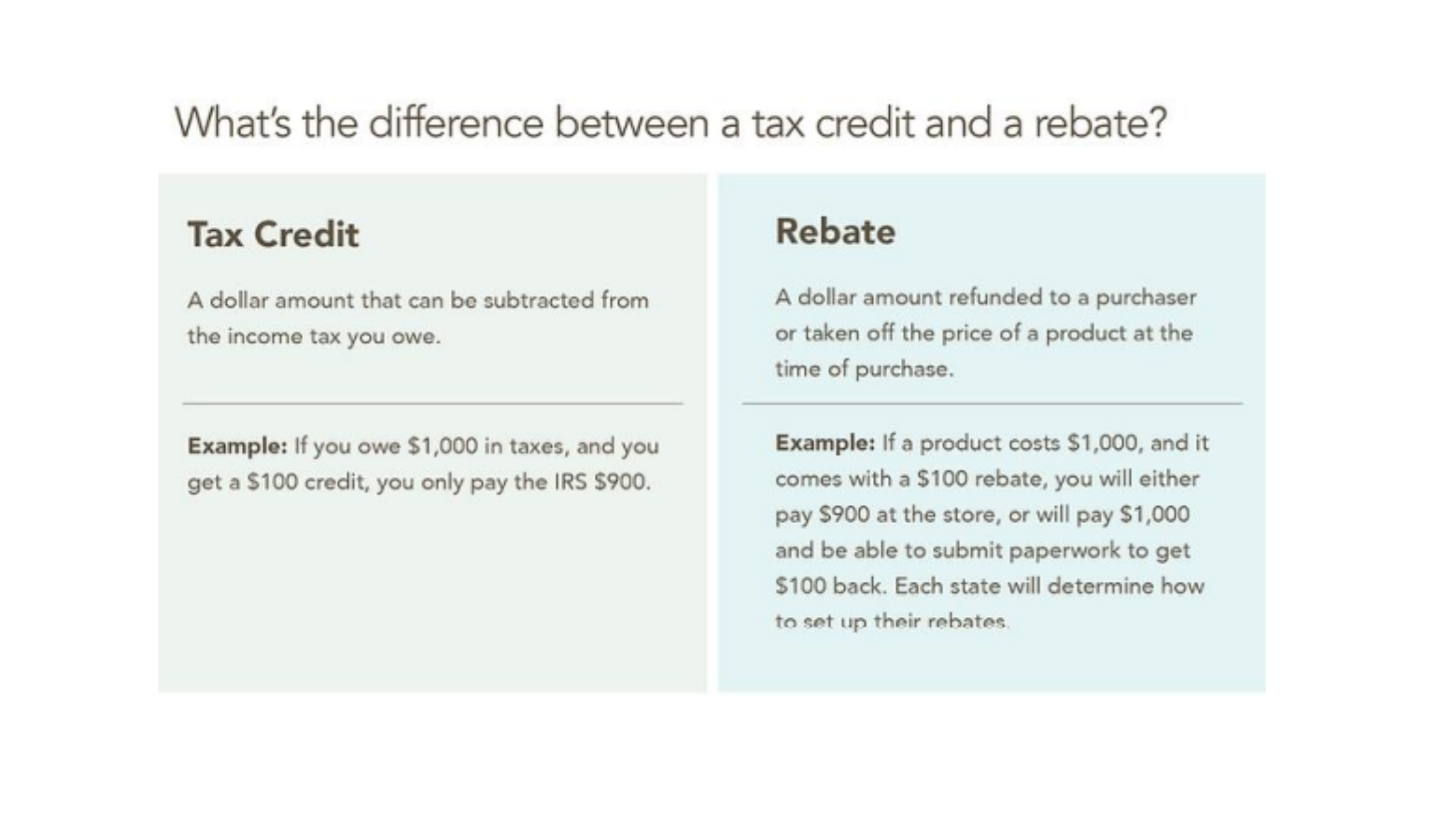

Fortunately, a new federal program is offering homeowners incentives to pay for home

energy improvements. Passed in August 2022, the Inflation Reduction Act (IRA) provides tax

credits and rebates to American consumers for eco-friendly upgrades and may help households

reduce their electricity costs by as much as $170 to $220 a year.

Here are four key IRA provisions that can help you pay to increase your home’s energy

efficiency:

For more information on how each program can benefit you, visit the White House's

website dedicated to clean energy.

Energy Efficient Home Improvement Tax Credit that will help you Go Green

Beginning in 2023, you can claim a tax credit of up to 30% of the costs of eligible energy

improvements to help you go green. The amount you can claim varies by the type of

improvement and is subject to cap of $1,200 per year, or $2,000 for electric heat pumps.

Because of the annual limits, it may make sense to spread out your improvements over multiple

years. For example, you could use the credit toward the purchase of an air conditioner one

year, and claim it again the next year to help pay for new windows and doors.

Types of improvements include:

• Home energy audits

• Energy-efficient exterior doors, windows, and skylights

• Certain types of central air conditioners, water heaters, furnaces, and appliances

• Heat pumps

• Electrical panel upgrades (in some cases)

• Insulation

Residential Clean Energy Tax Credit

Formerly known as the Residential Energy Efficient Property Credit, this provision allows a 30%

credit for the cost of installing certain systems that use solar, wind, geothermal, or biomass fuel

to produce electricity for your home. It can also be used for home battery packs. This

percentage drops to 26% in 2033 and expires after 2034.

Alternative Fuel Refueling Property Tax Credit

If you have an electric vehicle (EV), you can claim a credit of 30% of the cost to install

recharging equipment, with a limit of $1,000. And if you don’t have an EV, check out related tax

credits of up to $7,500 for a new EV and $4,000 for a used one, subject to income and vehicle

price limits.

High-Efficiency Electric Home Rebates

Down the road, low-and middle-income Americans (defined as families earning less than 150%

of an area’s median income) will have access to another clean energy incentive in the form of

rebates on certain home improvements. Unlike federal income tax credits, these rebates will be

distributed out of $4.5 billion allocated to states, with each state establishing its own programs.

Availability (and amounts) of rebates will be determined by your state, and each qualifying

family is limited to $14,000 in total rebates.

Examples include rebates up to:

• $840 for qualifying models of appliances like stoves, cooktops, and heat pump clothes

dryers

• $1,600 for insulation, air sealing, and ventilation

• $1,750 for a heat pump water heater

• $2,500 for electric wiring and $4,000 for an electric panel upgrade (if needed to support

energy-efficient improvements)

• $8,000 for a heat pump for home heating/cooling

And remember … in addition to these incentives and the savings on your utility bills, your city or

state may offer additional rebates or tax breaks for energy improvements. Add that up and you

have plenty of ways to save money while going green!

This article is for informational purposes only. Note that exceptions, limitations, and restrictions may apply to any of these

scenarios.

Consult your tax advisor for more information.

We, People's Mortgage, are not endorsed by, sponsored by, or acting on behalf or at the direction of any government entity or program.